Sidiora Exchange · Paxeer Network

Sidiora Exchange Flagship exchange surface for Paxeer-funded wallets, operated by Sidiora Markets.

Sidiora Exchange turns protocol-governed balance sheets into live markets, internal price fabric, and routing for funded wallets across the ecosystem.

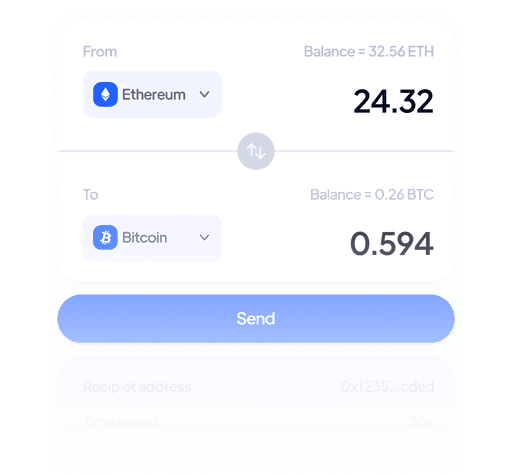

Markets

One app for everything you do with Paxeer

Sidiora Exchange pulls trading, swaps, portfolio and routing into a single surface. Funded wallets see the same positions, prices and limits everywhere - no separate dashboards, no fragmented balances.

Perp & spot trading

Route perps and spot without switching apps.

Exchange surface

A single flagship surface for funded wallets: connect once, trade across pairs, and let Sidiora handle routing and risk boundaries.

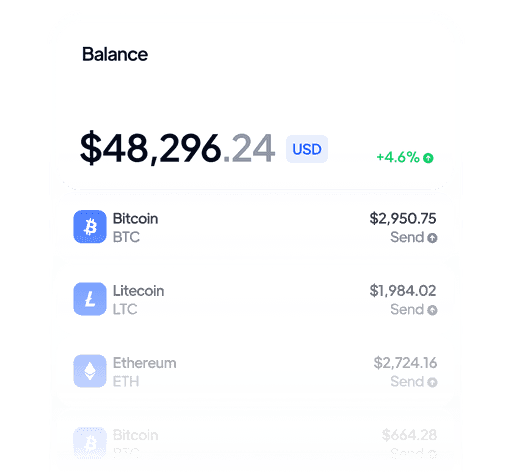

Portfolio & PnL

Track funded exposure, realized PnL and active risk across perps and spot from a single portfolio view.

Funded wallet experience

Trade from Paxeer-funded wallets that feel like normal accounts. Limits and sizing update in the background as you trade.

Smart routing

Orders hit Sidiora Markets routing under the hood so you see a single book and consistent fills, not venue-by-venue fragmentation.

Risk & protections

Built-in risk rails from Paxeer position limits, payout controls and telemetry as simple guardrails inside the app.

Sidiora Markets on Paxeer

Sidiora Exchange is the flagship trading surface run by Sidiora Markets. In the app, you see tight books, consistent prices and funded wallet limits; under the hood, Paxeer handles inventory, risk and settlement.

Market making

In Sidiora Exchange you always trade against live, two-sided curves quoted by Sidiora Markets. Spreads and skew are encoded into the ticket so you just pick side and size.

Best execution is handled for you; you see a single book and clear fills.

Liquidity provision

The app surfaces one depth ladder backed by multiple liquidity planes. You don't move balances between venues or products - your funded wallet can hit spot, perps and vault flows from the same account.

Liquidity adapts in the background; you stay focused on entries and risk.

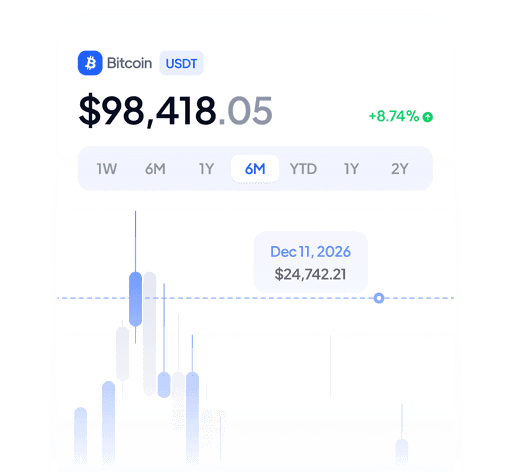

Price aggregation

Charts, tickers and order tickets in Sidiora Exchange all read from the same internal price fabric, built from multi-venue snapshots and path-aware filters.

You get consistent prices across spot, perps and portfolio with fewer surprises at fill.

Capital-to-user pipeline

Paxeer turns community pools into executable credit: capital flows from protocol vaults, through the risk engine, into funded smart wallets, and finally into positions on Sidiora Exchange powered by the Apex Perpetual Engine.

Community funding pools

ETH, OP, and staked PAX collateralize network-level capital that backs all funded activity.

Risk & payout engine

LLM + quantitative models continuously rescore every wallet and adjust limits, leverage, and payout eligibility.

Funded smart wallets

Wallets feel like normal accounts but are continuously sized by the network rather than static deposits.

Apex Perpetual Engine

Perp markets priced by PerpOracle, collateralized in ChainUSD, and surfaced via self-hosted TradingView and ApexFlow.

Built for traders, builders, and quants

Sidiora Exchange is a thin, expressive surface on top of Paxeer and Sidiora Markets. Use TradingView for precision entries, route risk into the network, and plug into the same capital rails that power everything else in the ecosystem.

For traders

Trade perps with network-provided capital, self-hosted TradingView charts, and a familiar order flow. No evaluation fees, no paywalled challenges.

- Precision entries with clear TP/SL tooling

- Isolated leverage, protocol-backed risk

- Transparent on-chain settlement

For builders

Compose new products on top of the Apex Perpetual Engine and Paxeer. Use the same funded wallets to deploy contracts, automate strategies, or build new UIs.

- Clean on-chain primitives for perps and collateral

- Price + funding data via PerpOracle and APIs

- Network-aligned incentives instead of siloed accounts

For quants & agents

Point agents and systematic strategies at perp markets backed by a capital-to-user pipeline and rich telemetry from the risk engine.

- Deterministic execution semantics

- Granular PnL and risk data per wallet

- Programmatic capital allocation over time

Part of the Sidiora + Paxeer ecosystem

Sidiora Exchange is the flagship exchange surface in a larger stack: Sidiora Markets for liquidity, Paxeer for settlement and capital routing, and ChainFlow for funded smart wallets.

First fully on-chain prop system: protocol-owned capital for everyone, network-level risk, and no paid evaluations.

Capital-to-user execution network for funded smart wallets and settlement.

Precision entries, cross-venue price aggregation, and liquidity programs that feed directly into perp markets.

$ sidiora-exchange connect --network paxeer ✔ Funding smart wallet from network pools… ✔ Routing orders through Sidiora Markets price fabric… ✔ Sidiora Exchange is ready to route your next trade.